Need Help with Bankruptcy Discharge? Contact Us Today for Personalized Solutions

Need Help with Bankruptcy Discharge? Contact Us Today for Personalized Solutions

Blog Article

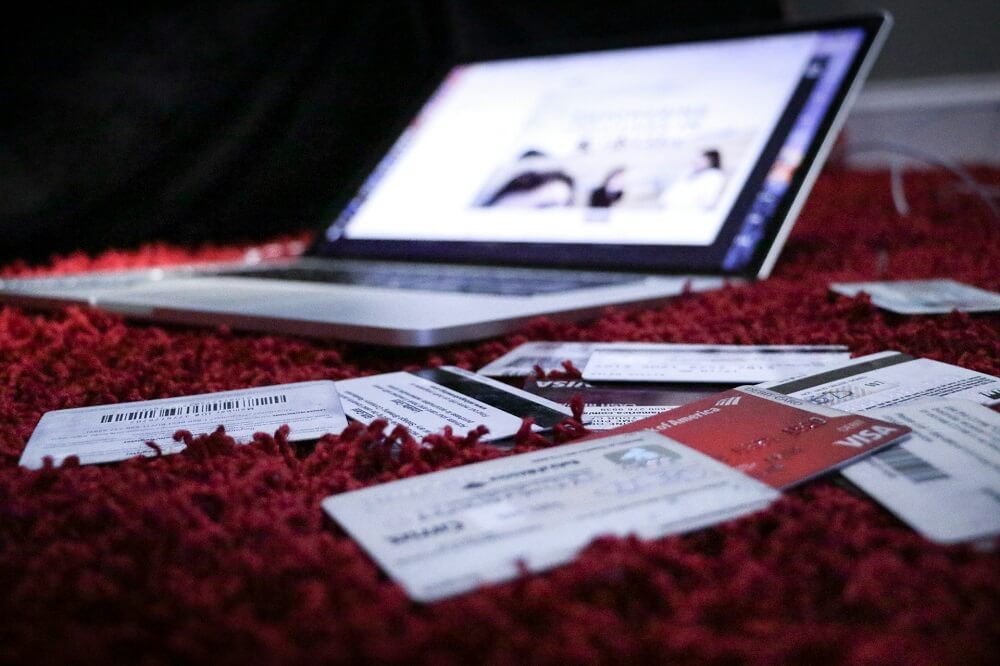

Browsing the Complexities of Personal Bankruptcy Discharge: The Value of Professional Support in Attaining a New Beginning

Navigating the elaborate landscape of bankruptcy discharge can be a challenging job for people looking for a financial fresh begin. By employing expert advice, individuals can browse the intricacies of insolvency discharge with self-confidence and increase their chances of achieving the fresh begin they look for.

Recognizing Bankruptcy Discharge Refine

The bankruptcy discharge process is a pivotal phase in the lawful treatment where financial obligations are relieved or discharged, supplying people with a fresh monetary start. This process notes the conclusion of a personal bankruptcy case, signaling the resolution of financial obligations for the filer. Once a personal bankruptcy discharge is provided, the debtor is eased of the obligation to settle particular financial obligations, providing a course to restore their financial standing.

To launch the personal bankruptcy discharge process, the borrower needs to initially file an application for insolvency with the court. This petition triggers an automated remain, stopping financial institution collection actions and offering the debtor with breathing area to browse the facility personal bankruptcy proceedings. Subsequently, the court will certainly assess the instance to establish the filer's qualification for discharge based upon the kind of bankruptcy filed, adherence to court demands, and other pertinent factors.

Upon successful completion of the personal bankruptcy discharge procedure, the court problems an order discharging the eligible financial obligations, approving the debtor a clean slate economically. It is crucial for individuals browsing insolvency to comprehend the discharge procedure completely and look for specialist assistance to make sure a smooth shift towards monetary healing.

Advantages of Professional Guidance

For people browsing the intricacies of bankruptcy, looking for professional support can significantly boost their understanding of the process and raise the probability of a successful economic healing. Professional support offers an organized technique customized to private situations, offering quality on the different alternatives available and the implications of each choice. Bankruptcy legislations are subject and intricate to regular changes, making it essential to have a knowledgeable consultant who can translate the lawful lingo and navigate the intricacies of the system.

In addition, expert consultants bring a riches of experience to the table, having collaborated with countless customers dealing with comparable difficulties. Their understandings can assist people anticipate possible challenges, strategy in advance to reduce threats, and plan for a smoother bankruptcy process. Furthermore, specialists can assist in preparing the required documents precisely and in a prompt fashion, minimizing the possibility of errors that might postpone the discharge procedure.

Eventually, the benefits of professional guidance prolong beyond simply the technical facets, supplying psychological assistance and reassurance during a challenging period. By employing the assistance of seasoned specialists, people can approach bankruptcy discharge with confidence and increase their chances of achieving a fresh start.

Complexities of Legal Demands

Navigating via the intricacies of bankruptcy discharge mandates a deep understanding of the complicated legal requirements that underpin the procedure. Personal bankruptcy legislation entails a web of regulations and laws that control the eligibility standards, filing procedures, and discharge problems. One essential legal need is the ways test, which establishes whether a private gets approved for Chapter 7 bankruptcy based upon their income and expenditures. Furthermore, recognizing the different types of financial debts, such as concern, safeguarded, and unsecured financial debts, is necessary in navigating the personal bankruptcy procedure. Each type of debt carries distinctive legal implications that can impact the discharge end result.

Moreover, compliance with court treatments, disclosure needs, and timelines is vital in ensuring an effective personal bankruptcy discharge. Failure to follow these lawful requirements can lead to hold-ups, rejections, or even legal effects. As a result, looking for expert legal assistance is indispensable in navigating the complexities of insolvency discharge. A seasoned bankruptcy attorney can offer advice on fulfilling legal responsibilities, advocating for the debtor's legal rights, and eventually attaining a fresh economic start within the bounds of the law.

Making Sure Favorable Result

To achieve a beneficial end result in the bankruptcy discharge process, critical preparation and thorough interest to information are essential. The very first step towards guaranteeing an effective personal bankruptcy discharge is to accurately complete all needed documents and divulge all relevant financial info. This includes offering in-depth details about assets, obligations, income, and expenditures. Any kind of omissions or mistakes can endanger the end result of the discharge procedure.

Looking for assistance from experienced insolvency attorneys or monetary consultants can help people navigate the intricacies of the insolvency discharge procedure and boost the likelihood of a favorable end result. By complying with these actions and seeking expert assistance, people can improve their chances of acquiring a successful insolvency discharge.

Professional Support for Financial New Beginning

Seeking professional advice from experienced bankruptcy lawyers or economic advisors contributes in accomplishing an effective monetary fresh beginning post-bankruptcy. contact us today. These specialists possess the expertise and experience required to navigate the intricacies of bankruptcy discharge and offer important assistance in Continued restoring your financial future

Financial consultants, on the various other hand, deal customized financial preparation to help you gain back control of your finances after bankruptcy. In verdict, employing the support of these specialists is crucial in setting on your own up for success after insolvency.

Conclusion

Finally, looking for specialist assistance is vital for navigating the intricacies of the insolvency discharge process. Specialist support can aid people recognize the legal requirements, guarantee a desirable outcome, and eventually achieve a monetary fresh start. By depending on the expertise of experts, people can better navigate the complexities of insolvency discharge and set themselves up for success in restoring their economic future.

Browsing the detailed landscape of bankruptcy discharge can be a difficult job for individuals seeking a financial fresh start.The insolvency discharge procedure is a pivotal phase in the my link legal treatment where debts are relieved or discharged, giving individuals with a fresh monetary begin.To start the personal bankruptcy discharge procedure, the borrower should first submit a petition for insolvency with the court. Looking for support from knowledgeable bankruptcy attorneys or economic experts can aid people browse the intricacies of the personal bankruptcy discharge process and boost click here for info the possibility of a positive end result. By depending on the knowledge of specialists, individuals can much better browse the complexities of personal bankruptcy discharge and set themselves up for success in rebuilding their economic future.

Report this page